How to Stop Wage Garnishment in Nova Scotia

When a creditor looks to garnish wages from you, it is a scary process. Not only do you get threatening letters and calls weeks, if not months before it occurs, but the court system is also involved, which can be quite intimidating.

While a wage garnishment may seem impossible to stop, there are several remedies you can use to stop wage garnishment before it does too much damage.

If you are being garnished in Halifax, Dartmouth, or anywhere else in Nova Scotia, you will learn the ins and outs of how wage garnishment works, how to stop creditors from garnishing your wages, and how to get back on track financially.

Who can garnish wages in Canada?

The first thing to understand is who can garnish wages? Typically speaking, anyone you owe money to can take you to court and obtain a judgment and court order granting them the ability to garnish your wages.

- By the way, if a collection agency or creditor is threatening this, don’t worry too much just yet but do take it seriously and look at your options to prevent it; typically it takes months from when you begin receiving these threats to when a creditor will try and obtain a court order against you.

This includes, but isn’t limited to:

- Regular creditors like credit card companies and banks,

- A credit union,

- Payday loan companies,

- CRA / Canada Revenue Agency,

- Ex-spouses to who you owe alimony or child support.

CRA & wage garnishments for child support are treated a little differently.

- The Canada Revenue Agency can garnish your wages without a court order and typically garnish much more than the provincial limits. Usually, they garnish 30% of your gross wages after your mandatory deductions. This typically equals approximately 50% of your take-home pay.

- If you owe child support or alimony arrears, your ex can seek the assistance of maintenance enforcement. However, they fall under special rules, and even bankruptcy cannot stop these types of wage garnishments, so it is best to keep on top of these payments whenever possible.

What is the most that can be garnished from wages?

The question ‘How much can they garnish my wages for’ comes up all the time for people facing garnishment concerns.

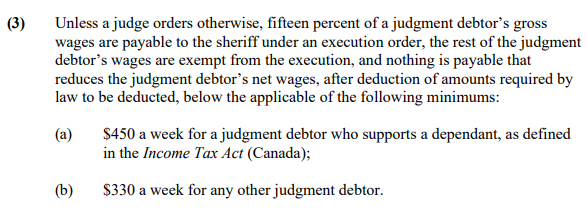

According to Nova Scotia, Rules of Civil Procedure, Section 79.08 Para (3), 15% of a debtor’s gross wages can be garnished unless a judge orders otherwise.

There are limits to how much they can garnish. According to the same section, your wages cannot be garnished to make your income drop below $450 per week if you support a dependant, or $330 per week if you do not.

How do you know if your wages will be garnished?

You will typically be well advised if a creditor intends to intact a wage garnishment. The process typically follows a lengthy collection attempt period from a collection company and the original lender themselves.

After this, you will typically be contacted by a law firm (which may be the collection agency) who will threaten a garnishment. And finally, you will be issued a notice of action or a notice of debt which starts the legal process. Usually, a creditor must show the court that they have attempted to contact you on multiple occasions.

These papers will typically be served to you in person, so it is quite hard to miss.

How can I stop a wage garnishment immediately?

A consumer proposal or bankruptcy are only two processes that can be used to stop a wage garnishment immediately. This is because both of them come with a stay of proceedings, which is a legal process that stops all legal action against you.

Both options are filed through a licensed insolvency trustee. Licensed Insolvency Trustees are federally regulated to implement the Bankruptcy and Insolvency Act (which governs the consumer proposal process). Every licensed insolvency trustee has a fiduciary duty to the creditors in either your consumer proposal or bankruptcy.

A consumer proposal is an alternative to bankruptcy that usually involves offering your creditors more than they would otherwise get if you filed a bankruptcy.

A bankruptcy is the most severe form of debt relief and is based upon your household income, family size, and assets.

What does being garnished mean?

Being garnished means that someone you owe money to has decided to go to court against you and request the court grant an assignment of wages against you to benefit them. This means that the court will force your employer to pay your creditor a portion of your paycheck to pay back the debt you owed them.

What money can be garnished?

Usually, all sources of income can be garnished with few exceptions, such as some government benefits. A creditor who is garnishing you for a debt you owe them can also obtain authorization to seize assets as well. This usually allows the creditor to take funds out of your bank account or obtain a judgement against a property you own.

How do you get out of wage garnishment?

There are four main methods of getting out a wage garnishment in Nova Scotia.

- Work to pay off the amount owing. Once the debt in question is paid off, the wage garnishment will stop,

- Despite having a garnishment order, some creditors will still negotiate and settle with you,

- Filing a consumer proposal, or

- Filing an assignment in bankruptcy.

Options #3 & 4 are filed through a licensed insolvency trustee; however, we recommend obtaining unbiased debt relief advice.

What is exempt from garnishment in Canada?

Most forms of income can be garnished. However, typically speaking, EI payments, CPP, OAS and other government benefits cannot be garnished. This is typically because they are exempt by the legislation themselves or fall under the income limits indicated above.

Can a lawyer stop wage garnishment?

Yes and no. A lawyer may be able to help you appeal a judgement order in certain circumstances but to legally stop a wage garnishment quickly, you usually are looking to file either a bankruptcy or consumer proposal.

Can debt collectors take money from your paycheck?

Without a legal garnishment order, a debt collector cannot take money from your paycheck.

In fact, many creditors now ask for voluntary wage assignment paperwork to be signed. In Nova Scotia, these are not lawful. This means a creditor cannot actually enforce this legally.

Can a collection agency garnish your bank account?

Without a court order allowing your creditors to seize assets, a collection agency cannot garnish your bank account. However, most debt paperwork is written up that if you default on the debt (miss payments, for example), the debt becomes payable in full immediately. This can sometimes allow the creditor to try and debit your account for an amount up to the balance owing.

How can I stop a garnishment order?

A garnishment order can only be stopped in 3 ways:

- You pay off the debt,

- The creditors decide to revoke their right (usually happens if you settle the debt),

- Or by filing a consumer proposal or bankruptcy.

Conclusion

When dealing with a creditor looking to garnish your wages or who has already started a wage garnishment, don’t hesitate to reach out for professional help. The last thing you want is to wake up on payday and have less money in your bank account than you had planned. A garnishment doesn’t have to be the end of your financial life – it is a setback that can be dealt with with the help of a professional.

This article was written by David Moffatt, a Debt Relief Expert. He has helped assist in creating plans that have helped save Nova Scotia residents over $30 million dollars of consumer and tax debt since 2015. We believe that no consumer should have to struggle with the stress of overwhelming debt. Our debt restructuring strategies can help you cut your debt by up to 80%.

If you are struggling with debt please reach out. It hurts to continue to suffer financially. Halifax Debt Freedom services Halifax, Dartmouth, Bedford, Sackville the entirety of HRM, and all of Nova Scotia.